Debt, Leverage And Financial Trouble

Debt, Leverage And Financial Trouble

Economy/General | Jan 2026

Inferential Focus

Auto, Banks, Bonds, Borrowing, Business, Canada, Cars, Companies, Competitive Life, Consumer, Consumer Behavior, Consumer spending, Corporations, Credit, credit cards, Debt, Digital Asset Treasuries, Economy, ETF, Federal Reserve, Finance, France, Gambling, Government, Inflation, Italy, Japan, Leverage, Nationalism, Risk, Shadow Banks, Taxes, UK, US, Utility Bills

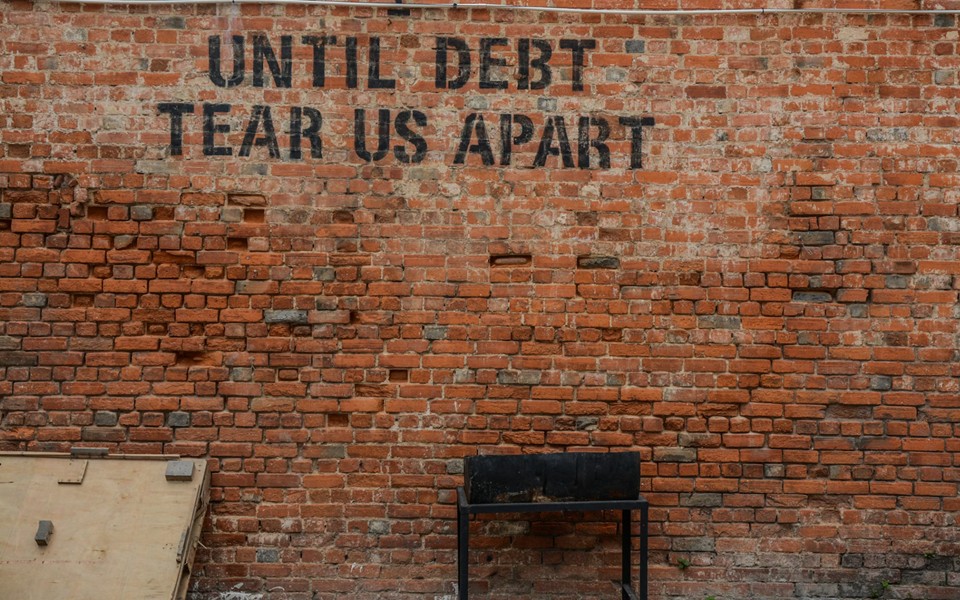

Can the economy withstand record debt held by individuals, corporations and governments all at once? Americans are about to find out, as are citizens of many other developed economies. Incentives for individuals, “opportunities” for corporations and demands for governments have made debt, or “leverage,” the go-to tactic to make ends meet. Over time, however, leverage has started to cause concern. Can all these debts be kept current? And if consumers, businesses and governments do manage to stay current, what will that do to the economy? Consumers need better pay to keep pace with inflation, but businesses need to cut costs to make cash available to meet debt and other obligations. This dynamic is made less predictable because the U.S. government would need to pull back on its current practice of plopping down hundreds of billions of dollars in interest payments into the private sector for its ballooning debt. Mitt Romney says the economy is headed for a cliff, while the current U.S. administration says the debt is under control, even as the Fed has started putting liquidity into the market and has begun to buy Treasurys. Debt is reaching record amounts, and risks are seemingly surpassing safe levels, all while market concern does not match those realities.